The integration of robotic process automation in insurance is currently a robust strategy that elevates operational efficiency. Forecasted information from Statista claims that by 2030, roughly 46% of existing insurance claims and policy processing roles in the United States will be automated. Besides, the projected growth of the global RPA market size indicates an increase to over 13 billion U.S. dollars by 2030, marking a substantial rise of more than 12 billion dollars from the 2020 insights. How can we employ RPA solutions to the procedures within the insurance industry, and why will it be beneficial?

In this article, we’ll delve into the twelve core RPA use cases that have skyrocketed processes within the insurance industry. From expediting claims processing and automating underwriting tasks to ensuring regulatory compliance and elevating customer experiences, let’s define the reasons RPA has become a versatile instrument for insurers aiming at innovation.

Table of Contents:

Claims Processing

RPA can substantially elevate claims processing within the insurance industry by seamlessly automating core associated tasks. Initially, claims processing covers a range of human-made steps, from retrieving data on paper claim forms to validating policy data and inputting data into claims processing software. RPA brings in a vast, accelerating transition to optimize this complex and time-consuming procedure.

Employing advanced data retrieval opportunities, RPA solutions seamlessly and precisely assemble the details for retrieval. The robotized extraction from claim forms liquidates the need for long-drawn-out manual data entry. Further, the technology validates policy data, guaranteeing accuracy and compliance with predetermined regulations and guidelines. Robotic process automation speeds up the claims processing timeline and minimizes errors inherent in manual data handling. In practice, the implementation of automation in insurtech can cut the cost of a claims journey by up to 30%, as McKinsey claims.

The robustness and accuracy of claims processing you can achieve with insurance RPA services directly boosts customer satisfaction. Your policyholders fully enjoy liquidated long waiting times, rapid resolutions, and smooth interactions within the claims procedures.

Streamline Claims with RPA

Learn how RPA revolutionizes claims processing, boosting efficiency and accuracy.

Policy Administration

In the field of policy administration, RPA streamlines the policy issuance, renewal, and endorsement processes by automating the complex steps involved in handling policy-related data. Thus, RPA brings top-tier efficiency to these critical processes.

As for policy issuance, RPA helps you extract core data from diverse sources (e.g., application forms, customer databases, and regulatory documents). With automation, you can substantially accelerate this process and minimize the possibility of errors that may occur within the manual data inlet. RPA software guarantees in-time and accurate updates by automatically validating policy details against set criteria. RPA-powered data cross-referencing facilitates smooth and hassle-free renewal processes, preventing oversights and ensuring compliance with evolving regulations.

Another area in which RPA offers benefits is policy endorsements, where modifications and updates to existing policies are not extraordinary. Here, the solution boosts the validation of alterations and updates policy information accurately, elevating the performance effectiveness and ensuring that policyholders benefit from the most recent and accurate coverage.

Underwriting Support

Underwriting highly focuses on the assessment of risks, and RPA is a robust assistant for underwriters’ data gathering and analysis tasks. RPA becomes crucial for automating the complicated process of extracting relevant information from a range of external databases, a task which traditionally laden with manual effort and long-lasting research. In a recent survey, “Intelligent Underwriting” involving over 500 underwriters, Accenture Research revealed that insurers were placing a high priority on leveraging data, concurrently integrating RPA and contemporary policy underwriting platforms. 75% of underwriters identify a factor that could significantly enhance their productivity. On average, underwriters allocate 40% of their time to data gathering and entry.

Underwriting highly focuses on the assessment of risks, and RPA is a robust assistant for underwriters’ data gathering and analysis tasks. RPA becomes crucial for automating the complicated process of extracting relevant information from a range of external databases, a task which traditionally laden with manual effort and long-lasting research. In a recent survey, “Intelligent Underwriting” involving over 500 underwriters, Accenture Research revealed that insurers were placing a high priority on leveraging data, concurrently integrating RPA and contemporary policy underwriting platforms. 75% of underwriters identify a factor that could significantly enhance their productivity. On average, underwriters allocate 40% of their time to data gathering and entry.

This is why underwriting teams can use Robotic Process Automation in the insurance industry to efficiently handle vast repositories of data to congregate all-around risk profiles. The solution allows for carefully analyzing structured and unstructured data, rapidly retrieving integral insights and patterns that underwriters need to make wiser decisions. Consequently, underwriting process times are accelerated, with the likelihood of oversights related to human data handling being liquidated. As per McKinsey, the implementation of RPA in the insurance sector has the potential to decrease data processing time by 34%.

Last but not least, the combination of RPA and insurance elevates the precision of risk assessment by mitigating the risk of human failures in data interpretation. A single investment of RPA cost can save you lots of human resources and efforts, delivering lasting cost-saving opportunities. The automated system provides a consistent and standardized approach to assessing risk factors, facilitating a more qualitative and transparent underwriting process.

Premium Collection and Billing

Premium collection and billing represent core verges of the business cycle, requiring precision and efficiency. RPA is important here, as it guarantees seamless operations and financial accuracy.

It can enhance the procedure of the reconciliation of premium payments, a task prone to errors and time-consuming when performed by human workers. With advanced algorithms, RPA systems smoothly compare payment data against policy details, identifying discrepancies with outstanding accuracy. By implementing custom RPA, you can eliminate errors and boost the reconciliation flow, creating a responsive financial ecosystem.

The generation of invoices and the billing workflow can also be refined with RPA. The automation of invoicing processes ensures that billing is conducted swiftly with no impact on accuracy. RPA software can retrieve relevant data, such as policy details and premium amounts, from the necessary sources, further generating invoices with precision. Thus, there are no billing errors, fast billing cycles, and optimized cash flow for insurance vendors.

Customer Onboarding

Basically, onboarding incorporates manually assembling, verifying, and entering customer data. This may lead to potential errors, delays, and higher operational expenses. RPA addresses these obstacles by automating key onboarding tasks.

RPA facilitates the precise and smooth gathering of customer data by seamlessly integrating with various data sources, such as forms, emails, and third-party hubs. You can be sure of the completeness and accuracy of details, liquidating the faults that arise because of manual data input. Background checks, a key component of onboarding, are expedited via RPA capacity, which can rapidly access and examine required data for compliance and risk assessment. In addition, RPA accelerates the creation of customer profiles in the system, ensuring a seamless, intuitive, and convenient onboarding roadmap.

Data Entry and Data Migration

RPA accelerates tasks that have initially been labor-intensive, prone to errors, and time-consuming. The streamlining of large-scale data entry tasks, particularly the input of customer details into databases, guarantees high accuracy and efficiency in populating databases with customer data. The Canadian claims management provider, SCM Insurance Services, achieved an 80% reduction in claims processing time by fully automating data entry for First Notice of Loss (FNOL).

Withwal, RPA proves invaluable in data migration between systems, a complex and critical operation for insurers frequently updating their technology infrastructure. RPA bots can seamlessly extract, modify, and load data from one system to another, ensuring a smooth transition while mitigating the risk of errors associated with manual intervention. Thus, you can boost the data migration process and minimize downtime and operational disruptions.

Regulatory Compliance

Addressing the complex sector of regulatory compliance is another use case of RPA in insurance. This is especially critical for health insurance and life insurance, guaranteeing that your insurance company adheres to laws and regulations set by government authorities. Compliance safeguards consumer interests, promotes fair practices, and maintains the integrity of the insurance industry, making you a credible partner for policyholders and stakeholders while providing a framework for ethical and responsible business conduct. Still, it’s vital to remember that regulatory environments are undergoing continuous alterations due to regular modifications. This demands more attention to guarantee absolute adherence. RPA excels in automating the monitoring and reporting of regulatory changes, offering a proactive approach to compliance management.

RPA systems can be programmed for ongoing scanning and analysis of regulatory refinements from diverse sources (like government agencies and domain watchdogs). Here, Machine Learning algorithms, in combination with RPA tools, can intelligently filter relevant data, determining the impact of regulatory changes on insurance processes. This real-time tracking opportunity allows businesses to stay ahead of compliance demands and seamlessly fit into their operations.

On top of that, RPA allows the generation of compliance reports with excellent rapidity and accuracy. By robotizing the retrieval, synthesis, and delivery of data, RPA makes sure that compliance reports are not only created in a timely manner but are also free from the faults that often go hand in hand with manual data handling. Therefore, you liquidate non-compliance risks and enhance the power of internal audit flow.

Showcasing successful examples, ERGO, a German-based insurer, faced challenges complying with a legal requirement that mandates the transfer of active contracts when clients switch insurance brokers. The manual effort involved in handling numerous requests was oppressive. To address this, ERGO adopted Blue Prism’s RPA in insurance services, saving over 2000 hours of manual labor to fulfill these regulatory obligations.

Fraud Detection and Prevention

It is wise to apply RPA for automated analysis of huge amounts of data, where this technology can substantially elevate the identification of distrustful patterns and abnormal behavior that may indicate fraudulent activities.

RPA algorithms can identify incoherence, which might be undetected in the context of human-made checks, in transactions, claims, and customer interactions. The technology skyrockets the processing of vast datasets, enabling it to capture even more sophisticated deviations from established standards. RPA can learn and adjust to changing fraud patterns via predefined rules and solid algorithms, ensuring a powerful and dynamic defense against fraudulent actions. For example, this may be beneficial in P&C (Property and Casualty) insurance policies to mitigate financial losses, maintain pricing accuracy, and uphold the integrity of the insurance system.

Upon determining potential fraud, RPA can initiate immediate alerts to designated employees or systems, facilitating a timely and concentrated investigation. The instant response capability and engagement of manual intelligence, when needed, is crucial in preventing further financial losses and safeguarding the integrity of insurance processes.

Transform Your Insurance Operations

Discover how our RPA solutions can optimize efficiency, reduce costs, and enhance customer experience.

Customer Communication

In the context of policy management, RPA can be applied for robotizing the dissemination of critical details to customers, catering to a seamless and timely flow of updates. This covers processes like sending policy updates, renewal reminders, or other essential notifications; RPA enhances effectiveness and consistency in interactions and communication. As per Deloitte’s survey, 41% of participants have switched insurers due to unsatisfactory customer service.

Setting automated workflows that trigger communications according to predefined events or milestones is one of the most effective insurance use cases for RPA in building durable customer-business relationships. This eliminates the necessity for human involvement along with manual errors so that your customers receive accurate and relevant data. It is also worth mentioning that RPA facilitates personalized communication by extracting and integrating customer-specific data into messages, thereby enhancing the overall customer experience.

A tailored RPA system can excel your business by scheduling and sending renewal reminders, preventing lapses in coverage, and thus enhancing customer satisfaction. To boot, insurance robotic process automation enables compliance by guaranteeing that all necessary notifications, such as regulatory updates or policy changes, are swiftly delivered to customers.

Document Management

A critical aspect of insurance operations is document operation. It is often burdened by the vast volume of paperwork generated in policy issuance, claims processing, and other related activities. In case you would like to handle this problem, RPA can easily delegate the challenges associated with document management in the insurance industry.

RPA is invaluable in document sorting, organizing, and classification, efficiently categorizing diverse documents based on the established criteria. Leveraging intelligent algorithms, RPA systems can determine document types, such as claim forms, policy documents, or endorsements, streamlining the organization of immense document repositories.

Data retrieval from documents is another key strength of RPA in document management. Optical character recognition (OCR) and machine learning capabilities come in to help, allowing RPA bots to extract relevant data from unstructured documents accurately. As a result, you are now capable of extracting data from scanned forms, handwritten notes, or digital documents, ensuring the seamless integration of information into insurance systems.

Finally, among the other RPA insurance use cases, we can mention updating records. After extracting pertinent data, RPA bots can automatically update databases and records, cutting down the reliance on manual data entry. This way, RPA hits two birds with one arrow, decreasing the risk of errors while also enhancing the speed at which records are maintained up-to-date.

Reconciliation of Accounts

Automating the reconciliation of accounts through RPA skyrockets the financial flows within the insurance industry. This use case involves deploying RPA bots to systematically compare and align financial transaction records, such as ledgers, archives, and financial statements, within diverse systems. The traditional manual reconciliation process is inefficient, obsolete, and, most importantly, prone to human errors, leading to contradictions that can have significant financial subtexts.

RPA can be advantageous in this case by simulating human performance, extracting data from disparate sources, and cross-verifying entries, but much faster and more precisely. The automated bots can reconcile extensive volumes of transactions, identify suspicious actions, and highlight them for further investigation. Thus, you not only elaborate on the accuracy of financial reporting but also care about the full adherence to regulatory requirements.

Moreover, RPA is powerful because it handles routine reconciliation tasks, allowing human resources to be allocated for more complex and strategic aspects of financial management. The automation of account reconciliation reduces the risk of financial failures, eliminates the potential for fraud, and elevates overall financial transparency, making it a seamless, error-free process while facilitating financial integrity and reliability.

Workflow Automation

Workflow automation via RPA tailored to end-to-end business workflows introduces maximum efficiency and accuracy. In this use case, RPA serves as a digital workforce, seamlessly navigating through complex workflows, coordinating a broad spectrum of diverse tasks across agency departments, and handling crucial handoffs. For instance, according to the UiPath AI platform, Encova Insurance saves up to 25 hours a week, enhancing client experience with RPA. Besides, within 8 months, Australian Unity reclaimed 22,493 hours of manual labor. What’s more, Security Benefit, a North American insurer, achieved a savings of 40,000 labor hours in a single year through workflow automation.

RPA in the insurance industry is valuable for optimizing daily and rule-based procedures and reducing the workloads and pressure on your human resources. This gives you the opportunity for a wiser manual effort allocation, with a focus on more strategic and complex activities. It facilitates the integration of disparate systems, ensuring smooth communication and data transfer between disparate systems. By robotizing workflows, RPA eliminates human errors and accelerates the capacity of processing, leading to robust operational accuracy and cutting down cycle times. Obtaining the opportunity to save expenses as well, after implementing only 13 RPA robots, another global insurance provider realized savings of £140,000 within six months, as the same resource states.

In the Robot Factory project, we’ve seen firsthand how RPA revolutionizes insurance operations. By automating tasks like eDocs management and policy renewal, we helped Quandri’s clients save over 120 hours per month on manual document processing. Another real-world use case involved integrating RPA with compliance systems to ensure regulatory adherence and reduce operational risks. These examples illustrate RPA’s transformative potential in streamlining repetitive tasks, improving accuracy, and freeing up valuable resources for strategic growth.

Santé.app

Santé.app simplifies finding the right health insurance with an intuitive tool that uses surveys to sort & compare insurance offers efficiently.

AI Platform

We developed an AI platform that automates admin processes, improving service quality & operational efficiency in European medical institutions.

Robot Factory

Robot Factory software revolutionizes insurance tasks with automation, streamlining document management & accelerating workflows by up to 90%.

With RPA, you stay compliant with predefined business rules and regulatory requirements throughout the entire workflow of your insurance organization. It’s essential to minimize the risk of failures, obtain a transparent and auditable trail of activities, and contribute to regulatory adherence.

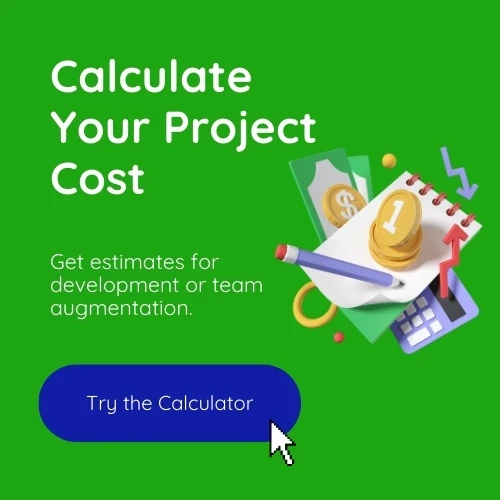

The integration of RPA in the insurance industry brings in a powerful strategy for efficiency, security, and the highest precision. Through the described use cases, RPA is demonstrated to be a robust solution, automating tasks ranging from claims processing to customer onboarding. As an output, you receive a highly efficient and prosperous company characterized by streamlined workflows, no errors, absolute compliance, and a vast base of devoted customers because of excellent service. With RPA services, you are guaranteed to unfold the power of saved resources, decreased expenses, and heightened operational efficiency.